Latest news and insights

China to the rescue of the glass bottle production crisis

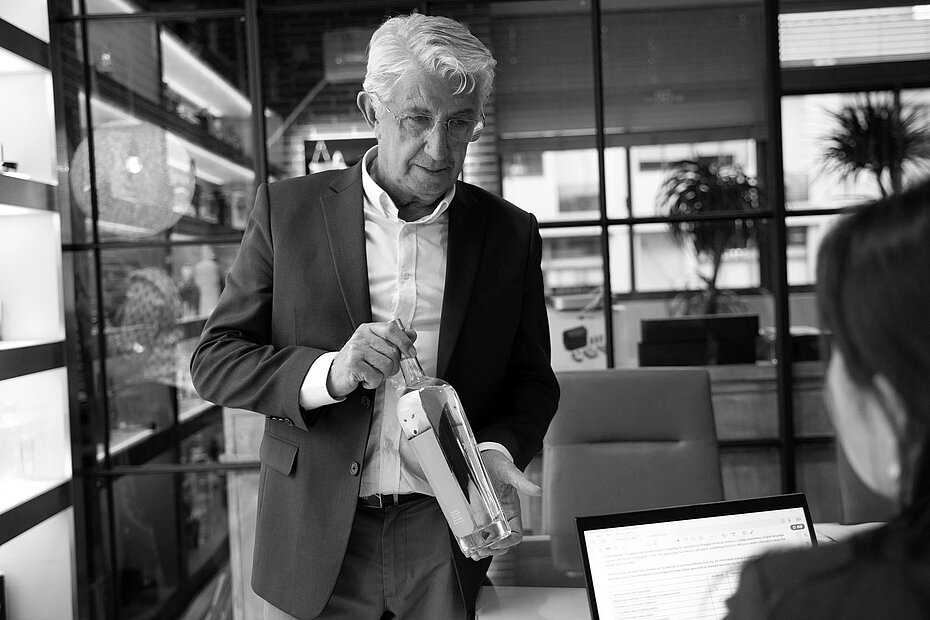

A discussion with Henri Berthe, CEO, Rockwood Glass Group, China.

Since June 2022, a surge in material costs, supply chain disruptions, increased energy prices, and international economic pressures, have led to a 20% - 40% rise in glass production costs throughout Europe and the USA.

The war in Ukraine is a contributing factor to the dire effect on the glass industry since gas and energy prices have spiked as a result of the conflict. Across Europe and the US, price increases and surcharges are being added to client orders at a rate that is hurting order quantities and future forecasts. But this is not the case for the clients of French-owned, China-based glass bottle manufacturing company, Rockwood Glass Group.

“Although China’s geopolitical position may be questionable at times, there is no gas shortage, and thus no problem feeding the glass furnaces.”

Henri Berthe, CEO, Rockwood Glass Group, China.

According to Henri Berthe, new and existing clients have recently placed additional orders for over 1 hundred million glass bottles. These were placed predominantly by companies in North America, Mexico, and Italy, which are not having their needs met by their usual producers.

Rockwood aims to continue compensating for global glass shortages throughout the next 5 years, during which the glass-supply crisis is forecasted to continue.

How are the Rockwood glass manufacturing plants keeping up with the influx of new glass bottle orders?

Berthe states that in anticipation and quick reactivity to the crisis, the European-owned glass company in Shanghai built numerous new furnaces, created new production lines, and increased capacity by approximately 100,000 tons.

As a result, Rockwood clients continue to benefit from:

- Efficient turnaround times with unmatched speed-to-market from bottle conception to production and delivery.

- Diligent European standards and French leadership coupled with:

- Lower Chinese production costs.

- Low minimum order quantities (20,000 units for glass bottles).

- Molds costing less than one-tenth of the prices found in Europe and the USA.

- Established export routes to 24 countries.

- Flexibility and reactivity to client requests.

China as a whole is consistently rampingup production to meet rising global demands in glass, which otherwise risk remaining unfulfilled. Berthe believes that international clients must reevaluate their supply chain based on the importance of splitting glass bottle supply across various countries, including China. This will ensure their company’s continuity, growth, cost-savings, and consistency in their customer service standards.

China’s Zero-COVID Policy in retreat

On December 5th, China began the rolldown of its relentless Zero-COVID Policy. This is already having a positive effect on both morale and business, as residents can envision a return to some sense of normalcy, and industries can start to focus on putting new systems in place for a more profitable future. China is forecast to regain its exporting clout within the first quarter of 2023.

Unlimited gas availability, limitless production capacity, freight rates expected to drop to pre-pandemic rates, and a workforce eager to resume optimal performance, make China a key player in the relief of the global glass supply crisis.

Rockwood Glass Group is China’s largest bespoke glass and ceramic bottle factory, producing over 650 million bottles annually. It serves some of the largest premium brands in the spirits and beverages arena globally. In addition to producing flint and super flint glass, Rockwood produces 40 million black glass bottles per year. It is the only manufacturing company in the country that works with cobalt blue glass.

Rockwood Glass Group in Shanghai is ready to take your orders. If you are interested in discovering how you can collaborate with Rockwood on the design and production of premium bespoke glass bottles, contact us for a free project consultation.